BACK

BACK

05/18/2023

AN INCREASE IN THE NUMBER OF REVERSE SPLITS AS A COROLLARY TO DILUTIVE FINANCING.

Reverse split transactions have become increasingly common in France in recent years. They very often follow the issuance of dilutive financing instruments such as convertible bonds. New financiers have recently appeared on this playing field, creating a population of zombies and aggrieved minority shareholders.

In 2020, the Autorité des marchés financiers (AMF) warned investors of the risks associated with dilutive financing underwritten by listed companies. It has since published several analyses on the subject. One of these studies measured the consequences of the issuance of these financial products on the share price performance of the companies concerned between their initial listing and December 31, 2021. The results speak for themselves, with an average fall in share price of 72% for 83% of the companies in the sample (i.e. 69 companies). Only 17% saw their share price increase.

The AMF's warnings have not prevented the proliferation of penny stocks and reverse splits. Often ill-informed about the disastrous consequences of dilutive financing, or lacking alternatives in the absence of a proven business model, the sometimes unscrupulous managers of listed companies have largely profited in recent years from the arrival of new investors in this segment. And sometimes to postpone an inevitable bankruptcy filing.

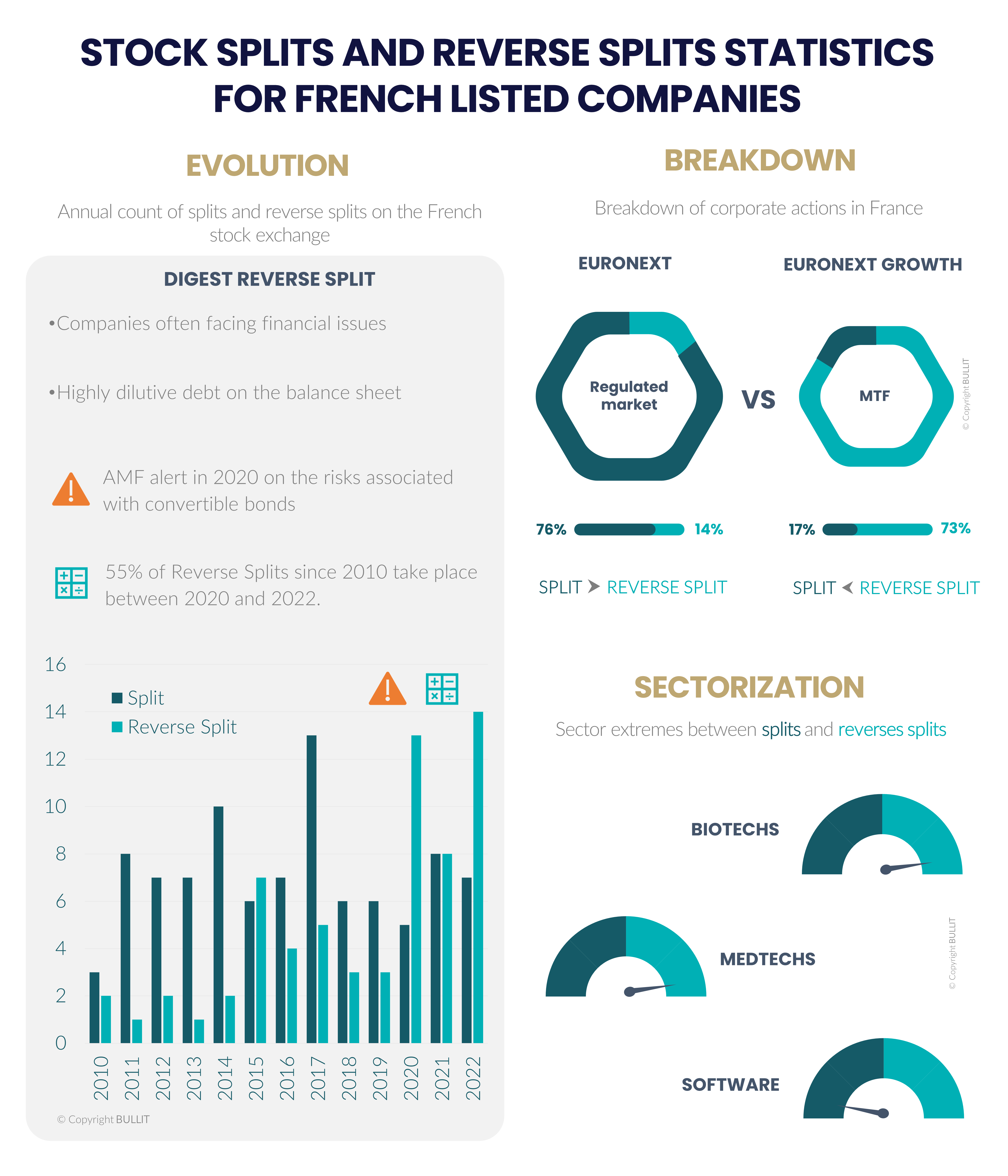

MORE REVERSE SPLITS SINCE 2020

Reverse splits often serve two purposes. In addition to enabling issuers to (temporarily) move out of the penny stock category and artificially boost the company's image, in most cases it also enables them to continue issuing shares and bringing in cash. With the rapid fall in their share price, linked to the massive sale of shares by holders of dilutive products who enjoy a subscription discount, it quickly becomes impossible for the issuer to continue financing its cash consumption. This is all the more true as financing contracts are often for amounts far in excess of the company's market value. As it is impossible to issue new shares at a unit price lower than the par value of the shares making up a company's share capital, the reverse split makes financing possible again by reducing the number of shares making up the share capital and increasing the par value of these shares in the same proportions.

We have collected data on reverse splits carried out in France, on Euronext markets, since 2010. Out of a population of over 60 companies having carried out a reverse split, it is interesting to note that around 55% of these transactions took place between 2020 and 2022. Some companies have carried out as many as 4 reverse splits in less than 10 years.

Reverse splits are mainly concentrated in the healthcare sector, and particularly in the medtech and biotech segments. This is hardly surprising, given that most companies in these sectors have not yet reached the stage of self-financing, or even consume a great deal of resources for results that are sometimes far from expectations. The more difficult it is to obtain new conventional financing (capital increases and dry bond debt), the more these companies tend to turn to dilutive financing, often constituting a point of no return for the stock market track record and the minority shareholder. However, the most recent contracts regularly include early termination clauses for both parties, breaking the vicious circle of dilution in the event of the issuer's return to better fortunes.

Our study also shows that the most suitable market for this type of operation is the regulated Euronext Growth market. We also point out that an MTF does not protect shareholders as much as a regulated market, in a context where transfers from one to the other are legion, with no way out for shareholders.

We will shortly be publishing a study on transfers between markets subject to ESMA's European rules and those whose rules are defined by the local market operator.

#corporateactions #reversesplit #convertiblebonds #dilution

____