BACK

BACK

05/23/2024

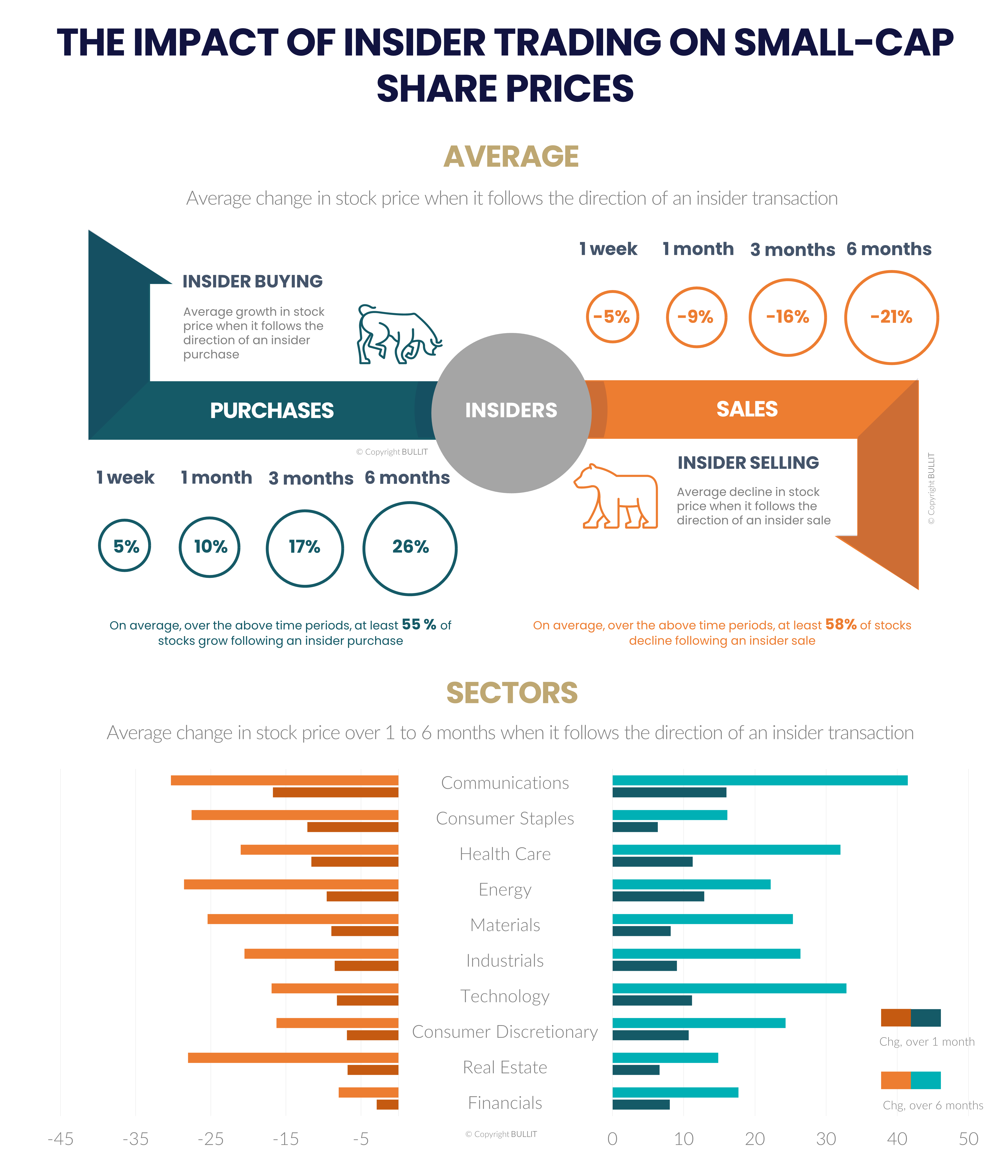

THE IMPACT OF INSIDER TRADING ON SMALL-CAP SHARE PRICES.

Insiders are required to report to the financial markets authority (AMF) when they trade directly or indirectly in a listed asset, so that this information can be made public. This European measure (MAR-19) aims to guarantee transparency and prevent market abuse.

Using algorithms, we have collected nearly 37,000 transactions over a period of almost 8 years to measure the impact of insider trading on the share prices of listed companies. Our analysis reveals that among French listed companies with a market capitalization of less than €1 billion, the share price trend following insider trading is far from random.

In 55 % to 60 % of cases, over periods of one week to six months, the share price of a company traded by an insider moves in the same direction as the insider's share, i.e. it falls after a sale and rises after a purchase. And when the price actually follows the insider's order, its average variation is significant. It is around -5% over a week and more than -20% over six months after a sale. Contrariwise, when an insider buys shares and the price goes up, it rises by an average of +5% over a week and more than +25% over six months.

TRANSACTION THRESHOLDS TO KEEP A CLOSE EYE ON AND SOME SECTORS ARE MORE SENSITIVE THAN OTHERS

In our data frame, some industries are particularly sensitive to falls. The share prices of companies in the communications sector (advertising, marketing, production of multimedia content), for example, have fallen in average by as much as 30% over six months following the sale of shares by an insider. The consumer staples and energy sectors are also showing larger-than-average swings. By contrast, the finance sector is little affected by the phenomenon, probably because of its strong regulations and well above-average compliance standards.

Our investigations also reveal that the amount of insider transactions has a significant impact on future price movements. Sell orders of between €100k and €500k lead to greater negative variations, particularly in the €300k to €500k bracket. Similarly, when the order is expressed in terms of the number of shares making up the company's capital, transactions representing 1 % to 3 % of the capital lead to greater movements. Investors should pay particular attention to these thresholds.

As far as insiders are buying, the communications sector once again accounts for the most extreme share price movements ex post, followed by the technology and healthcare sectors. The trading thresholds for large price swings are less obvious than those for insider selling. Investors seem to be less sensitive to the size of the buy orders than to the size of the sell orders. Orders need to be for 3 % to 5 % of the capital to trigger larger-than-average movements.

The results of this study show that investors clearly have an interest in monitoring insider transactions and remaining vigilant about their impact on the small-cap segment. It has to be said that, at the very least, it has a psychological impact on investors and their degree of confidence in the company, and at worst, it is a proxy of a future change in the growth trajectory or profitability of issuers.

#insider #trading #impact #shares #smallcaps

____