BACK

BACK

06/12/2023

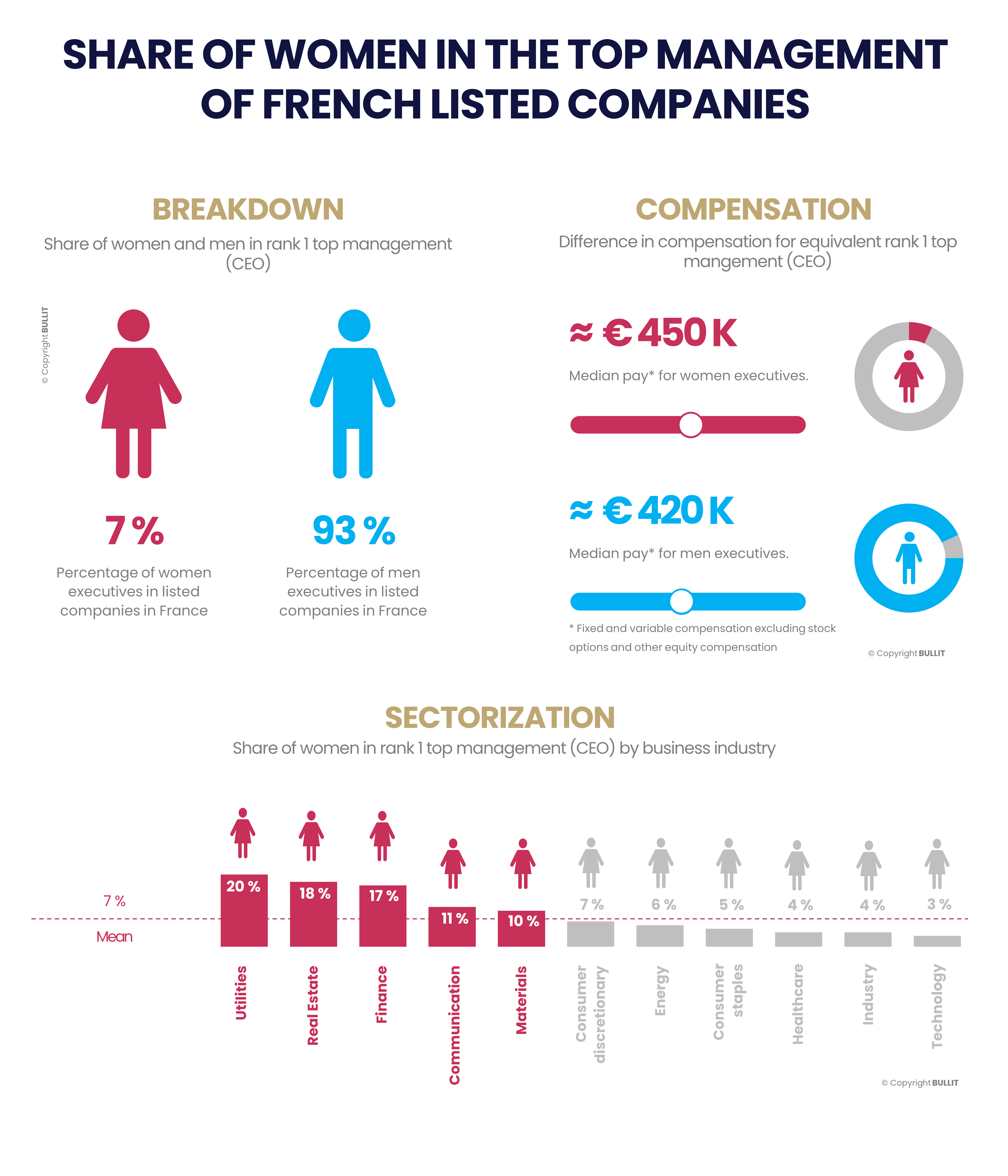

SHARE OF WOMEN IN THE TOP MANAGEMENT OF FRENCH LISTED COMPANIES.

In just a few years, ESG has become one of the main concerns of the financial asset management industry. While the proportion of women on boards of directors and supervisory boards has risen sharply, they remain under-represented in the operational management of listed companies, although their remuneration is close to that of men for companies of equivalent size.

Investors are no longer tolerant of companies that fail to provide clear, detailed ESG information. Mandatory on regulated markets, but established on a voluntary basis on MTFs, extra-financial reporting will become standardized between 2024 and 2026 as part of the CSRD directive. Auditing will be required from 2028 onwards. In the meantime, companies that fail to take full advantage of this opportunity run a significant risk of being eliminated from the prospecting field of investment funds, with the corollary of a significant increase in the probability of under-performing indexes and more difficult access to financing.

For the time being, the lack of harmonized ESG data means that it is not possible to draw up a global inventory of the French market. However, some data are relatively easy to collect, notably those concerning the ratio of men to women within companies. There are many reports detailing the proportion of women in shareholder representative bodies, but fewer dealing with the subject of companies' operational management (CEOs) and the gender pay gap in tier 1 positions. These data also have the advantage of being factual and harmonized, eliminating any room for interpretation, unlike environmental criteria, which depend largely on the scope and indicators chosen by issuers.

A CLEAR UNDER-REPRESENTATION OF WOMEN IN OPERATIONAL MANAGEMENT

In the French market, the result of compiling the data is indisputable. With more than 90% of top management positions held by men, compared with less than 10% by women, the findings are striking. In terms of remuneration, on the other hand, the statistics are quite satisfactory. While men's annual salaries average around 890 k€ versus 690 k€ for women, a difference of around 30% in men's favor, men on average run companies with a market capitalization of around 7 Md€ versus 5.6 Md€ for women, a gap of around 25%. Management positions are logically better paid in larger companies. And the astronomical figures for certain CAC 40 companies, particularly in the luxury goods sector, also skew the averages. The median, on the other hand, is tilted more in favor of women. Their median remuneration is around €450,000 versus €420,000 for men, i.e. a 7% gap in favor of women. They run companies with a median capitalization of around 570 M€, twice that of companies run by men (250 M€). There are two possible explanations for this phenomenon: large companies are more likely to integrate the feminization of their management into their strategy, and/or women are less likely than men to set up new businesses (around 40/60).

Disparities are significant when it comes to the representation of women in the highest management positions on the Paris stock exchange. None of the three largest sectors in terms of the number of listed companies - industry, consumer discretionary and technology - is ahead in the process of integrating women into operational management positions. The Consumer Discretionary sector is in the middle of the table, Industry in penultimate position and Technology in last place. On the other hand, women are better represented in Utilities, Finance and Real Estate, with a share of around 20% of CEO/Managing Director mandates.

We'll be updating our Europe-wide study shortly, once our algorithms have captured all the data. Follow us on social networks to be alerted.

#women #executives #stockmarket #compensation

____