BACK

BACK

05/30/2023

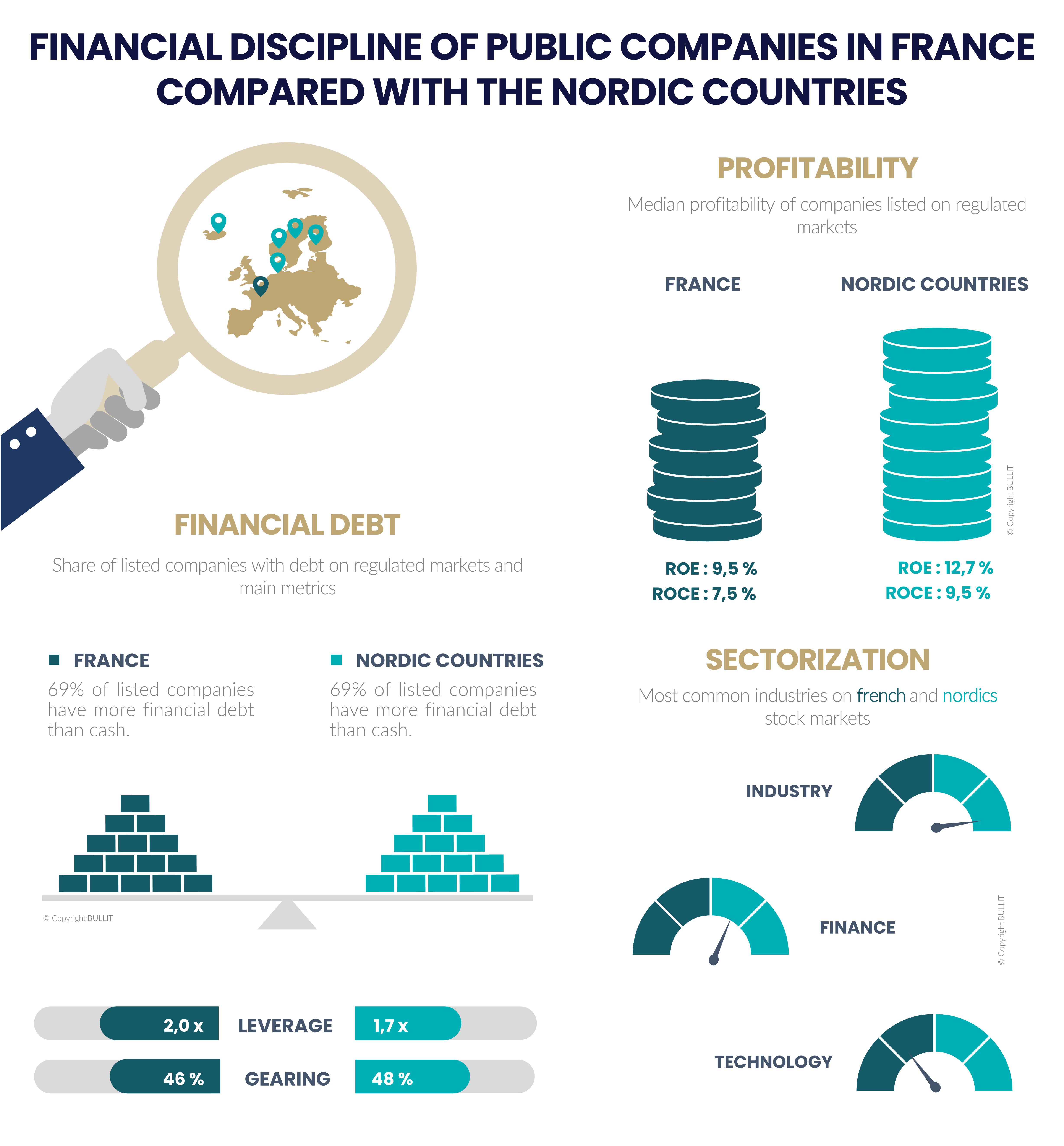

FINANCIAL DISCIPLINE OF PUBLIC COMPANIES IN FRANCE COMPARED WITH THE NORDIC COUNTRIES.

The Nordic countries have a reputation for extreme fiscal rigor in public finances. Their budget balance is only slightly in deficit, and even in surplus in some countries. They are also much more averse to massive indebtedness than Latin countries. This discipline is partly mirrored in listed private companies.

While France will have a public deficit of almost 5% in 2022, and a debt to GDP ratio of over 110%, the Nordic countries are at the opposite extreme, with a budget surplus of 5% and an average public debt of just 50%. Performance varies between the Nordic countries, with, at the extremes, a budget surplus of 26% for Norway thanks to oil versus a deficit of 4% for Iceland, a public debt of 30% for Denmark versus over 70% for Finland, and Sweden in the middle. But all have better economic indicators than France.

There's no secret about it: these northern European countries are best known for their rigorous management of national finances and extreme transparency when it comes to public spending. This phenomenon is less obvious in the micro-economy of these countries in terms of debt ratios, but is clearly visible in terms of profitability and return on capital.

Of just under 400 companies listed on France's regulated market, the proportion of companies with net financial debt is close to 70%, a level comparable to that of the Nordic countries as a whole, which have around 1,000 listed companies (excluding MTFs). Two countries stand out: Iceland, where over 85% of companies have debt in excess of cash flow, and Norway, where just over 60% are in this position.

Nor are debt ratios significantly different. The median financial leverage, i.e. net financial debt to EBITDA ratio for French listed companies, is 2 times, compared with 1.7 times for listed companies in the Nordic countries. The median gearing ratios, i.e. net financial debt to shareholders' equity, are virtually equivalent at 46% for France and 48% for the Nordic countries.

LISTED COMPANIES IN NORDIC COUNTRIES PROVIDE BETTER RETURNS ON CAPITAL

The median capital intensity of business models - i.e., the amount of investment required to generate revenues, measured by capital employed in relation to sales - is higher in the Nordic countries. It stands at over 110%, while in France it is less than 100%. Northern European countries are in fact more industrialized than France, where the tertiary sector reigns supreme.

Theoretically, the median ROE and ROCE of listed companies in France are higher because service businesses require little or no investment. But reality does not support this theory. Companies listed on the regulated market in France post a median ROE of 9.5%, well below the Scandinavian figure of 12.5%. The same applies to median ROCE, at 7.5% and 9.5% respectively. This result reflects the greater efficiency of Nordic companies in capital allocation and cost management... and, for those operating mainly at national level, a lower corporate tax rate, averaging around 20% compared with 25% in France.

The Scandinavian countries offer a wonderful playground for European investors, with a large number of listed companies. There are, however, a number of language and currency barriers. Not all listed companies communicate in English. And only Finland uses the Euro as its local currency. On the other hand, all these countries have adopted the ESMA market rules, whether or not they belong to the European Union, which implies, among other things, the use of IFRS standards.

#discipline #financialdebt #profitability #nordics

____